Keep Your Family well informed about your Financial Investments

September 14, 2022

Intellectual Property Rights – An Overview

September 29, 2022Quick Look At Deductions Under Section 80C To Section 80U

source: https://www.taxhelpdesk.in

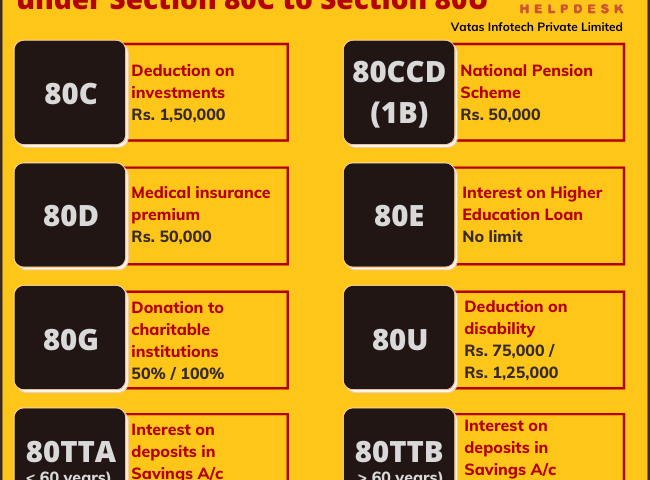

A Quick Look At Deductions Under Section 80C To Section 80U

25 April 2022 / Deduction In Respect Of Investments, Deductions Under Section 80C To Section 80U, New Tax Regime, Section 80C, Section 80DDB, Section 80EE, Section 80G, Section 80RRB, Section 80TTA & Section 80TTB, Section 80U

Deductions under Section 80C to Section 80U are covered under Chapter VIA of the Income Tax Act. The quantum of the deduction varies from Section to Section and type of person.

Exemptions & deductions provided under the Income Tax Act help in reducing the tax liability of persons during each financial year.

A lot many individuals find the current taxation system as difficult to comprehend. The taxation rates for individuals are based on the income earned by an individual and his residential status. The Government of India, has over the years by way of amendments in the Finance Act provided taxpayers in India with more than 70 exemptions as well as deductions options through which the individuals can bring their taxation liability. In this blog, we will discuss in detail the deductions under Section 80C to Section 80U

List Of Deductions Under Section 80C To 80U

|

Sections |

Income Tax Deduction for FY 2022-23 (AY 2023-24) |

Who can claim deductions? |

Deduction Limit for FY 2022-23 (AY 2023-24) |

|

Section 80C |

Deduction on investments like LIC, PPF, Tax Saving Fixed Deposits, ELSS, etc |

Individuals and HUFs |

Rs. 1,50,000 |

|

Section 80CCD(1B) |

National Pension Scheme |

Individuals |

Rs. 50,000 |

|

Section 80D |

Medical Insurance Premium and Medical Expenditure |

Individuals and HUFs |

Rs. 25,000 |

|

Section 80DD |

Medical Treatment of a Dependent with Disability |

Individuals and HUFs |

Rs. 75,000 / Rs. 1,25,000 |

|

Section 80DDB |

Treatment of specified diseases |

Individuals and HUFs |

Rs. 40,000 / Rs. 1,00,000 |

|

Section 80E |

Interest paid on Loan taken for Higher Education |

Individuals |

100% of the interest paid upto 8 assessment years |

|

Section 80EE |

Interest paid on Housing Loan |

Individuals |

Upto Rs 50,000 subject to some conditions |

|

Section 80EEA |

Interest paid on Housing Loan |

Individuals |

Upto Rs 1,50,000/- subject to some conditions |

|

Section 80EEB |

Interest paid on Electric Vehicle Loan |

Individuals |

Upto Rs 1,50,000 subject to some conditions |

|

Section 80G |

Donation to Charitable Institutions |

All Assessee (individual, HUF, company, etc) |

100% or 50% of the Donated amount or Qualifying limit, |

|

Section 80GG |

Income Tax Deduction for House Rent Paid |

Individual |

Least of Rs. 5,000 per month or 25% of total income or Rent Paid – 10% of total income |

|

Section 80GGB |

Contribution to Political Parties |

Companies |

100% of the amount contributed (should not be made in cash) |

|

Section 80GGC |

Individuals on contribution to Political Parties |

All assessee |

100% of the amount contributed (should not be made in cash) |

|

Section 80RRB |

Royalty on Patents |

Individuals (Indian citizen or foreign citizen being resident in India) |

Rs.3,00,000/- |

|

Section 80QQB |

Royalty Income of Authors |

Individuals (Indian citizen or foreign citizen being resident in India) |

Rs.3,00,000/- |

|

Section 80TTA |

Interest earned on Savings Accounts |

Individuals and HUFs (< 60 years) |

Rs. 10,000 |

|

Section 80TTB |

Interest earned on Savings Accounts |

Individuals and HUFs (> 60 years) |

Rs. 50,000 |

|

Section 80U |

Disabled Individuals |

Individuals |

Rs. 75,000 / Rs. 1,25,000 |

Deductions Under Section 80C To Section 80U Under The Tax Regimes

All the deductions under Section 80C to 80U are not available under both the tax regimes. That is to say, only deductions under Section 80CD(2) and Section 80JJA are available under the new tax regime. Whereas, under the old tax regime, all the deductions under Section 80C to 80U are available to the person eligible to claim them.